Professional Speaking Services

Investing in financial literacy is an investment in your people.

When employees are financially stressed, it impacts more than just their personal lives, it affects focus, productivity, and overall workplace morale. Studies consistently show that financial stress is one of the leading causes of anxiety, absenteeism, and even turnover in the workplace.

That’s why financial literacy training isn’t just “nice to have”, it’s a critical piece of employee wellness.

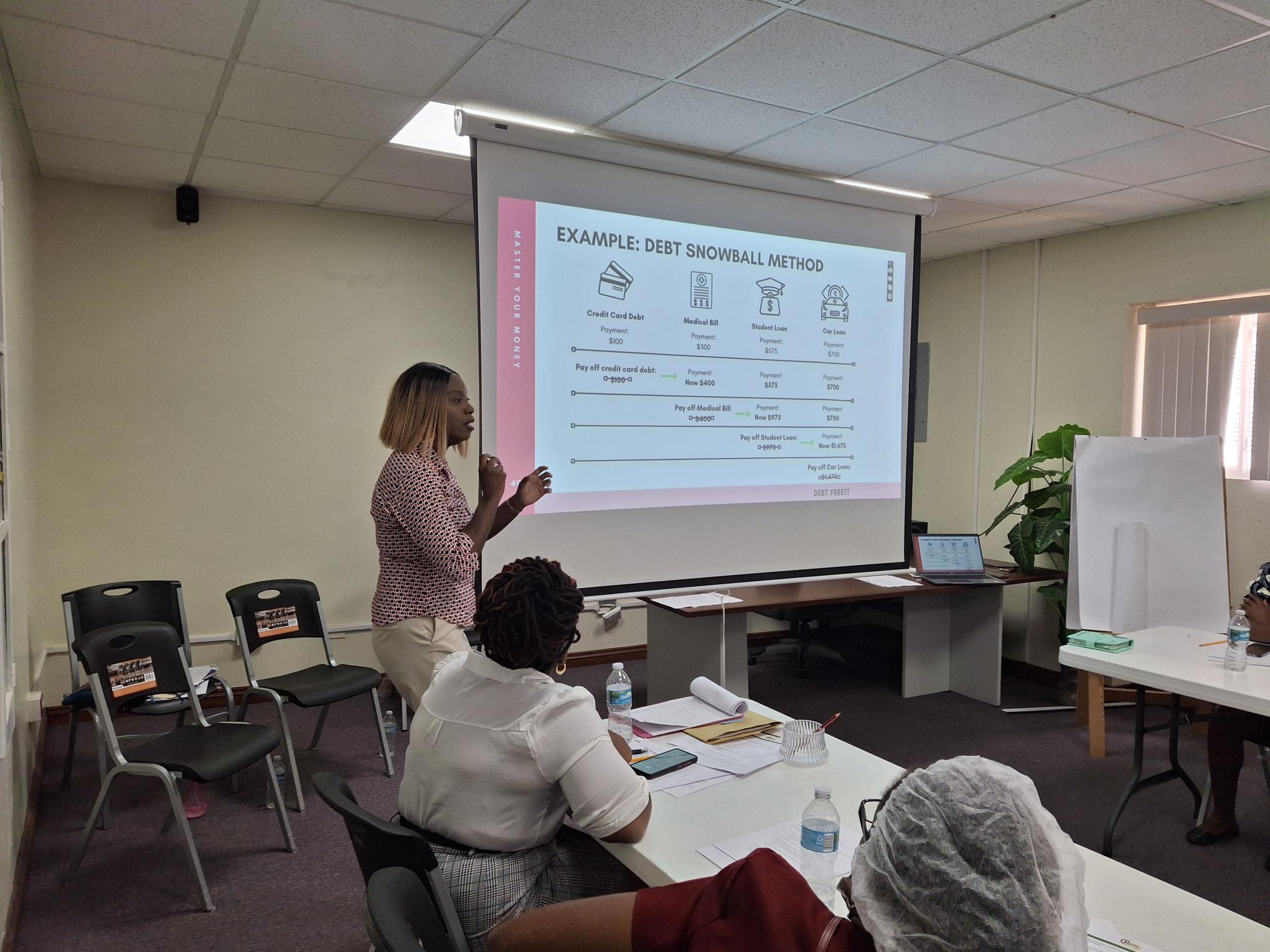

My Financial Wellness Workshops are designed to:

- ● Equip employees with practical tools to budget, manage debt, and save confidently.

- ● Build financial resilience so staff can handle unexpected expenses without panic.

- ● Boost productivity by reducing the distraction of money worries.

- ● Empower members and teams to align their finances with their goals, reducing burnout and increasing engagement.